Fifty years in the past, a secret deal amongst Arab governments triggered one of the traumatic financial crises to afflict the US and different huge oil importers.

Saudi King Faisal and different Arab leaders launched an oil embargo on Oct. 17, 1973, as payback for Washington siding with Israel in its battle with neighboring Egypt and Syria.

The oil market hostilities arose from a pact between Faisal and the leaders of Egypt and Syria, whose armies deliberate shock drives to retake their territory underneath Israeli occupation. If the US intervened to help Israel, Faisal and different Arab producers agreed to retaliate with the “oil weapon.”

When Washington airlifted in U.S. weapons that helped Israel thwart Arab positive factors, Faisal and OPEC’s Arab members retaliated. They elevated oil costs, banned oil shipments to the US and lower manufacturing by 5% monthly.

The following financial and political carnage is known. The embargo catalyzed an extended interval of upheaval in international oil markets and ache on the gasoline pump for Individuals and customers globally. Oil costs quadrupled almost in a single day and remained excessive for over a decade. Producing international locations leveraged the chance to reclaim sovereignty over their oil reserves. By 1980, many had accomplished the method of kicking Western oil corporations out of their territories.

Oil’s international regime change

The embargo’s disruptive energy was as a consequence of two key components: OPEC’s dominance of world oil provide, and oil’s supremacy within the international power combine.

Previous to the embargo, oil fueled virtually half of whole power consumption in the US (47.5%) and worldwide (49%). Whereas OPEC international locations produced greater than half (53%) of international oil, the concessions have been operated by Western oil majors.

After the embargo, producer states took over. Management of worldwide oil manufacturing handed from Western oil giants like Shell and Exxon to newly shaped nationwide oil corporations.

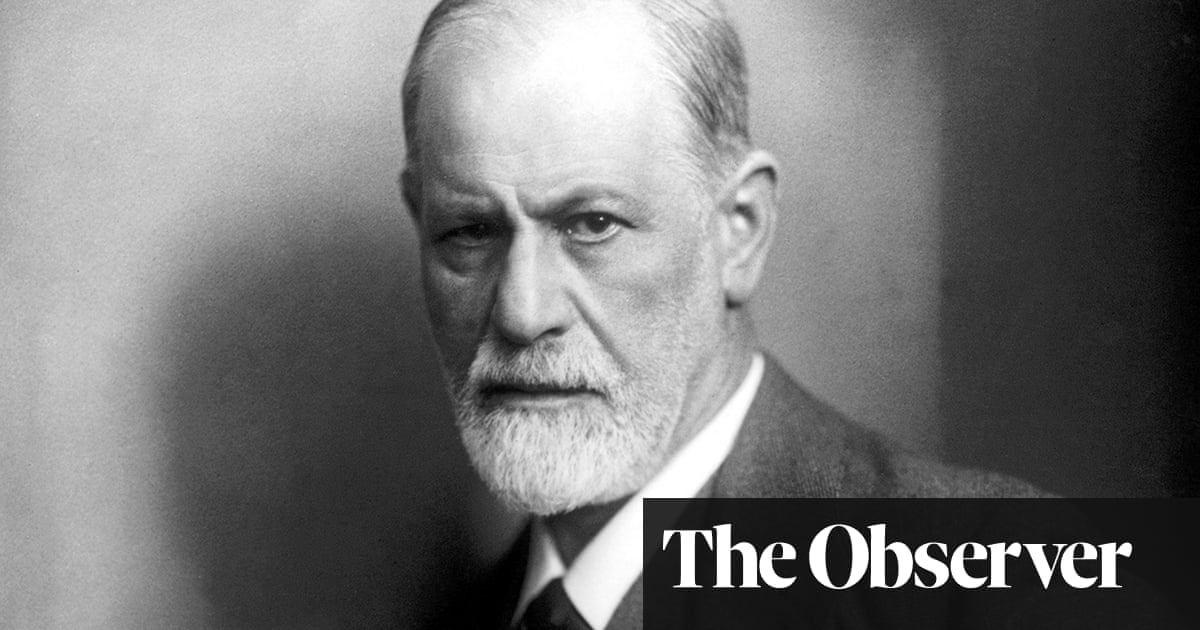

AFP through Getty Photographs

Because of this, a torrent of money from oil gross sales poured into Center Japanese international locations the place rudimentary providers like electrical energy have been nonetheless being constructed out. Oil revenues in Saudi Arabia jumped fortyfold between 1965 and 1975, from US$655 million to $26.7 billion. These international locations additionally amassed new geopolitical energy.

How the oil value spike performed out within the West

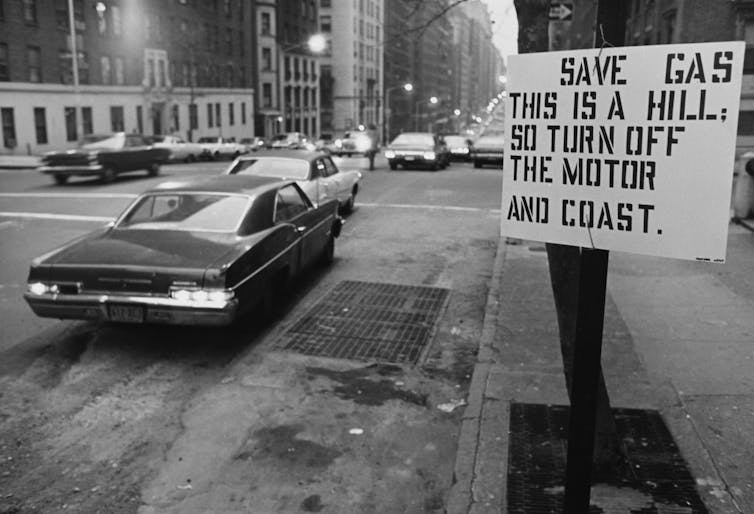

Within the West, value will increase wreaked havoc on economies and transport programs that have been far much less environment friendly than at present. Inflation quickly boiled over into “stagflation,” a mix of financial stagnation and excessive inflation. Misguided insurance policies, together with gasoline value controls and rationing, exacerbated shortages, creating lengthy traces at service stations and emboldening gasoline thieves.

America noticed a pell-mell downsizing of gas-guzzling automobiles and a simultaneous ramping up of imports of fuel-efficient Japanese automobiles. Drivers obsessed over miles per gallon, and the U.S. authorities imposed company common gas economic system, or CAFE, requirements, geared toward saving gas by requiring automakers to promote extra fuel-efficient automobiles.

Western oil corporations, kicked out of the Center East and different oil areas, pivoted to tougher terrain: the offshore Gulf of Mexico and North Sea, and the Arctic areas of northern Alaska.

Archive Pictures/Getty Photographs

As students of power coverage, we now have lengthy studied the embargo’s spillover results on the worldwide economic system and political programs. These outcomes are a central theme in Jim Krane’s 2019 guide “Power Kingdoms.” On the embargo’s fiftieth anniversary, Oct. 17, 2023, King Faisal’s son, the previous Saudi Ambassador to Washington Prince Turki Al Faisal, is becoming a member of us for a convention at Rice College’s Baker Institute to debate the still-valid classes of the Arab oil embargo.

50 years later, new pressures

Fifty years on, markets have modified. However oil continues to be the world’s dominant power supply.

On one hand, crude oil use has grown dramatically. International provide has risen from lower than 60 million barrels per day in 1973 to almost 94 million barrels per day in 2022. Motor gas costs are nonetheless a vital enter to inflation; we calculate that the enhance in gasoline costs in 2022 price the common American family roughly $1,000.

However, OPEC’s significance – and oil’s share of the worldwide power combine – has declined. OPEC’s 13 members account for simply 36% of worldwide oil manufacturing at present. The excessive oil costs brought on by the 1973 embargo created incentives for oil drillers to diversify towards new sources of oil and develop substitute fuels to exchange oil.

Inside 15 years of the embargo, manufacturing outdoors OPEC elevated by a large 14 million barrels per day. Oil from Alaska and the Gulf of Mexico helped stabilize U.S. manufacturing. Later, the shale revolution turned the US into the world’s largest producer and a internet exporter of oil, capping a 50-year quest.

The world has additionally change into far more environment friendly, lowering the quantity of oil wanted to take care of the identical exercise. International per-capita oil use per greenback of gross home product has fallen by a large 60% since 1973, our calculations present.

However, as in 1973, power safety considerations are again on the prime of nationwide agendas.

Russia’s 2022 invasion of Ukraine reprised the dangers of power “weaponization.” Europe, specifically, has been damage by overdependence on Russian pure gasoline and has raced to shift its power sources. The Israel-Hamas battle that started on Oct. 8, 2023, has not but ignited retaliatory responses from Arab governments, and the preliminary impression on oil has been minimal, however geopolitical results from such a big occasion may nonetheless roil markets.

Power safety itself can also be being altered. The transition to renewable power sources like wind and photo voltaic insulates customers from most provide chain dangers. Electrical automobiles likewise defend house owners from swinging oil costs. So, whereas essential supplies can nonetheless be manipulated by governments, shortages and value spikes primarily have an effect on element producers and their traders. If provides are bottlenecked lengthy sufficient, the power transition could possibly be delayed.

Carol M. Highsmith/U.S. State Division Bureau of International Public Affairs, CC BY-NC

Just like the embargo 50 years in the past, at present’s crises have rendered the way forward for power massively unsure. Modifications within the international power combine, particularly the fast progress of electrical automobiles, may weaken the significance of oil and the cartel that oversees it.

As former Saudi oil minister Ahmed Zaki Yamani was reported to have stated a quarter-century in the past: “The Stone Age didn’t finish for lack of stone, and the oil age will finish lengthy earlier than the world runs out of oil.”

Supply hyperlink