US Metal and Nippon Metal have filed a lawsuit towards Joe Biden’s order that blocked the $14.9bn buyout of the American steelmaker by the Japanese firm, they stated on Monday.

The lawsuit requested the courtroom to put aside the overview technique of the committee on overseas funding within the US and Biden’s order, citing “violation of the constitutional assure of due course of and statutory procedural necessities, in addition to illegal political affect”.

The case was filed in US courtroom of appeals for the District of Columbia circuit.

The businesses additionally filed a second lawsuit towards Cleveland-Cliffs, its CEO, Lourenco Goncalves, and David McCall, the USW union president, “for his or her unlawful and coordinated actions” geared toward stopping the deal.

Final week, Biden blocked the proposed buy on nationwide safety issues, dealing a probably deadly blow to the contentious plan after a 12 months of overview.

Nippon Metal paid a hefty premium to clinch the deal in December 2023 in an public sale, topping rivals together with Cleveland-Cliffs, ArcelorMittal and Nucor, in a guess on Biden’s infrastructure spending invoice.

Political and union resistance to the deal had amplified in latest months. Biden and Donald Trump, who is ready to take workplace later this month, had opposed the deal.

The White Home had urged for a scrutiny of the settlement, given US Metal’s core position in producing a cloth that’s essential to nationwide safety.

The Biden administration advised Nippon Metal in a letter that the deal would pose a nationwide safety threat by harming the US metal business, Reuters reported in September, citing sources.

The CFIUS, which was reviewing the deal, failed to achieve a consensus, setting the stage for Biden to dam the merger.

US Metal had warned {that a} failure to conclude a deal would put 1000’s of US union jobs in danger and had additionally signaled it could shut some metal mills.

It additionally stated it may probably transfer its headquarters out of the politically essential state of Pennsylvania.

Regardless of the opposition, US Metal shareholders overwhelmingly voted in April final 12 months to approve the acquisition.

The 2 firms have additionally labored to deal with issues over the mixture. Nippon provided to maneuver its US headquarters to Pittsburgh, the place US Metal is predicated and promised to honor all agreements in place between US Metal and the highly effective United Steelworkers union.

Nonetheless, the opposition has proved to be an overhang on the inventory. Shares of US Metal didn’t hit the provide worth of $55 per share, signaling investor worries over the timeline of the deal’s completion.

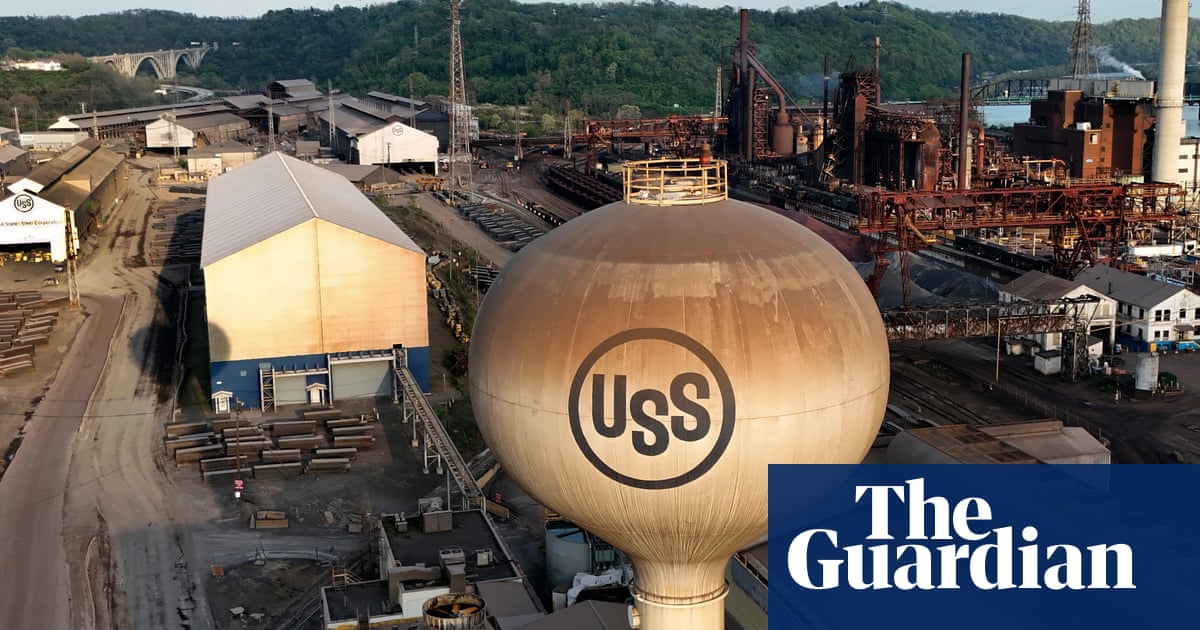

US Metal, based in 1901 by a number of the greatest US magnates, together with Andrew Carnegie, JP Morgan and Charles Schwab, turned intertwined with the economic restoration following the Nice Melancholy and second world warfare.

The corporate has been below stress following a number of quarters of falling income and revenue, making it a beautiful takeover goal for rivals trying to broaden their US market share.

Supply hyperlink