The Division of Schooling introduced Monday that it’ll resume collections on scholar mortgage debt subsequent month, together with by garnishing the wages of debtors in default.

Collections, which have been paused since March 2020, will resume on Could 5 and are anticipated to affect roughly 5.3 million debtors at the moment in default on their federal scholar loans.

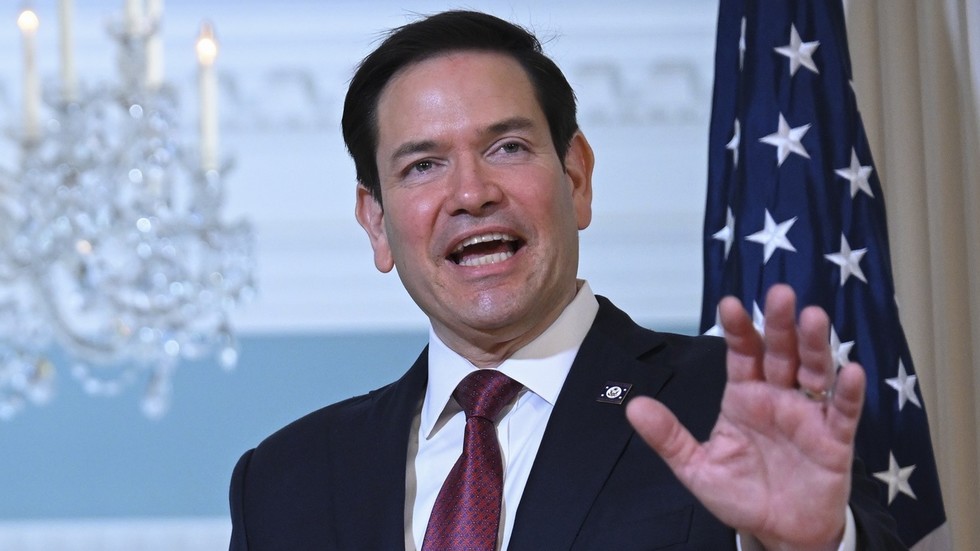

“American taxpayers will not be pressured to function collateral for irresponsible scholar mortgage insurance policies,” Schooling Secretary Linda McMahon stated in an announcement.

The schooling secretary went on to criticize former President Joe Biden’s efforts to cancel billions of {dollars} in scholar mortgage debt, a number of of which have been blocked by federal courts.

“The Biden Administration misled debtors: the manager department doesn’t have the constitutional authority to wipe debt away, nor do the mortgage balances merely disappear,” McMahon stated.

“Lots of of billions have already been transferred to taxpayers. Going ahead, the Division of Schooling, along side the Division of Treasury, will shepherd the scholar mortgage program responsibly and in line with the regulation, which implies serving to debtors return to compensation — each for the sake of their very own monetary well being and our nation’s financial outlook.”

Some 42.7 million debtors who owe greater than $1.6 trillion in scholar debt are pushing the nation’s federal scholar mortgage portfolio towards a “fiscal cliff,” the Schooling Division argued.

The company famous that greater than 5 million debtors haven’t made a single month-to-month fee in over 360 days and “many” haven’t in “greater than 7 years.”

“Because of this, there may very well be virtually 10 million debtors in default in just a few months,” the DOE stated. “When this occurs, virtually 25% of the federal scholar mortgage portfolio might be in default.”

“Solely 38% of debtors are in compensation and present on their scholar loans,” in line with the division.

The transfer to ship debt to collections was criticized by advocates for scholar mortgage forgiveness, who stated it should throw thousands and thousands of individuals into the “jaws of [the] authorities collections machine.”

“That is merciless, pointless and can additional stir up financial chaos for working households throughout this nation,” Mike Pierce, govt director of the Pupil Borrower Safety Heart, stated in a assertion.

The Schooling Division maintains that it’s dedicated to placing each debtors in default and people who are present “on a productive path towards repaying their federal scholar loans.”

“Over the following two months, [Office of Federal Student Aid] will conduct a strong communications marketing campaign to interact all debtors on the significance of compensation,” the Schooling Division stated. “FSA will conduct outreach to debtors by means of emails and social media reminding them of their obligations and offering assets and help to help them in selecting the right compensation plan.”

“FSA intends to enlist its companions – states, establishments of upper schooling, monetary help directors, faculty entry and success organizations, third-party servicers, and different stakeholders – to help on this marketing campaign to revive commonsense and equity with the message: scholar and guardian debtors – not taxpayers – should repay their scholar loans,” the division added, whereas noting, ”There is not going to be any mass mortgage forgiveness.”

“Collectively, these actions will transfer the federal scholar mortgage portfolio again into compensation, which advantages debtors and taxpayers alike.”

Supply hyperlink