When the world’s finance ministers and central financial institution governors collect on the Worldwide Financial Fund in Washington this week, it might kindle reminiscences of one other assembly, additionally held towards the backdrop of a world financial disaster, in autumn 2008.

Then, because the aftershocks from the collapse of Lehman Brothers ripped via monetary markets, central banks coordinated drastic emergency fee cuts, and the UK chancellor, Alistair Darling, urged his G7 counterparts to emulate the UK’s method and shore up stricken banks.

Coverage errors, together with lax monetary regulation, have been partly responsible again in 2008 – however as this week’s IMF and World Financial institution spring conferences convene, the chaos confronting key decision-makers within the world economic system has been totally manufactured within the White Home.

Donald Trump’s arbitrary “reciprocal” tariffs have been paused for 90 days, with many governments hoping they may by no means be reinstated. However the 10% across-the-board levy that continues to be in place – alongside eye-watering will increase in tariffs on the US’s nice geopolitical rival, China – nonetheless represents a historic shock to the worldwide buying and selling system.

The IMF, like nearly each different credible financial forecaster, is probably going to make use of its newest World Financial Outlook on Tuesday to warn of the hit to development. The Fund’s managing director, Kristalina Georgieva, has already steered the coverage poses “a big threat to the worldwide outlook”.

Given the character of the disaster, nonetheless, a united entrance, akin to that assembled in 2008, will likely be not possible.

As a substitute, completely different G7 economies are all making an attempt to handle Trump’s administration in their very own means. The UK authorities has declined to criticise the White Home brazenly, and is clinging to the shreds of the “particular relationship” – negotiating furiously within the hope the tariffs will likely be lifted.

The EU, dealing with a 20% levy if the complete tariffs are reintroduced, plans to retaliate. Mark Carney, the previous Financial institution of England governor now main Canada, is taking an aggressive, “elbows up” method, as he calls it, warning voters within the looming election that the connection between the 2 nations is irrevocably broken.

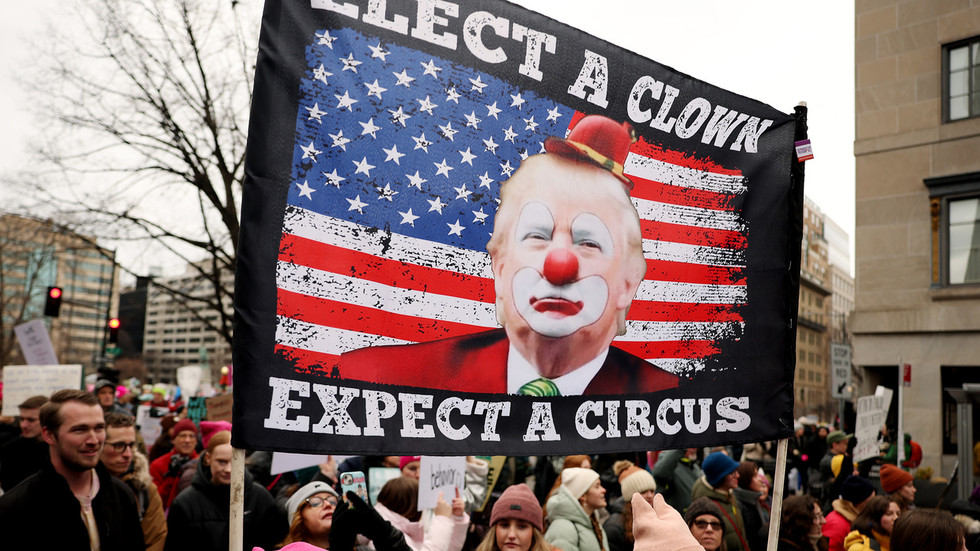

This cacophonous response is a part of the chaos Trump appeared to relish unleashing when he brandished his tariffs scorecard within the White Home rose backyard earlier this month.

It’s exhausting to think about something however essentially the most anodyne assertion being agreed by G7 finance ministers, a gaggle that can embody Trump’s treasury secretary, the previous hedge fund supervisor Scott Bessent. As a foretaste of Bessent’s doubtless method to his counterparts, he used a gathering with the Spanish economic system minister, Carlos Cuerpo, to assault Madrid for failing to spend sufficient on defence.

And as central bankers think about the outlook for wobbly bond markets and the potential dangers to monetary stability, in the meantime the independence of Federal Reserve chair, Jay Powell, lengthy a goal of Trump’s criticism, seems lower than safe. Given the significance of the greenback’s function, the Fed has beforehand been on the coronary heart of efforts to safeguard the worldwide monetary system. It’s unclear to what extent they might be able to play the identical function in a future disaster.

Gordon Brown, who was central to the worldwide response to the 2008 crash, has known as for a “coalition of the prepared” to deepen commerce ties between international locations exterior the US and defend the world’s poorest international locations from the influence of the coverage.

Previously, the G7 has typically been the locus for such collective motion. However this week’s assembly is occurring lower than a mile from the White Home, the place Trump’s commerce coverage is constant to evolve, one blustering press convention at a time.

Multilateral establishments, such because the IMF and its development-focused sister the World Financial institution, are additionally more likely to be targets of the Trump administration’s willpower to tear up the present world order, and minimize funding for any establishment that fails to place “America first”.

It stays to be seen whether or not any of the worldwide policymakers assembling in Washington are prepared to set out another imaginative and prescient to Trump’s – however even when they don’t, the conflict between the US and the remainder of the world will likely be on clear show; and, as in 2008, the omens for the worldwide economic system look bleak.

Supply hyperlink