Is loyalty or laziness costing me?

Individuals who don’t put within the legwork get charged extra. Financial savings accounts usually give a greater rate of interest for the primary yr, then it drops dramatically, as a result of they need you to only join and neglect about it. With cell phones you repay the handset inside a few years, however preserve paying the next price since you haven’t shopped round. Put a word in your calendar for when subscriptions and contracts will finish, since you all the time pay extra after they routinely roll on. Plenty of individuals opened a checking account for the free scholar railcard, and 30 years later they nonetheless have it. However there’s a switching service – it might really feel like an annoying piece of admin, however you possibly can save some huge cash.

How a lot do I would like in emergency financial savings?

Ask any monetary adviser how a lot you must have in an emergency financial savings fund they usually’ll say three to 6 months’ wage, however that may really feel intimidating. As a substitute, take into consideration what’s proper on your state of affairs: when you misplaced your job, would you have the ability to pay your lease or mortgage, would you may have any person else you possibly can dwell with? A conventional rule is 50:30:20, so 50% on necessities, 30% on belongings you need and 20% on financial savings, however that’s unrealistic now that necessities are so expensive, so some individuals have tweaked it to 60:20:20. Nonetheless you divide it, having a rule of thumb can assist ensure you’re all the time saving whenever you’re paid, fairly than making an attempt to avoid wasting from what’s left on the finish of the month. The important thing to saving is, when cash is available in, put it out of attain. Spherical-up apps, or a excessive avenue checking account that permits you to have “pots” you routinely switch cash to with out having to consider it, are nice.

What’s going to my retirement appear like?

Pensions generally is a actual supply of worry, and auto-enrolment means individuals by no means have a look at their pension pot, in order that they assume they’ll be sorted, however that’s hardly ever the case. The self-employed, in the meantime, should handle it themselves. Plenty of individuals depend on property, however property costs might fall, otherwise you may want care. You might assume you’ll get an inheritance, however there’s no assure that your dad and mom received’t want care, so paying just a little little bit of consideration to what’s in an organization pension, or beginning one when you’re self-employed, is essential. The earlier you begin, the much less you could save due to compound curiosity and funding return over time.

Do I actually know what is available in and goes out?

To begin a finances, you could know what’s coming in and going out, however only a few individuals do. There’s no level in pondering you could save half your earnings into your pension when you can’t afford that, so you must be life like, by trying on the distinction between the price of your necessities and earnings. Plenty of banks allow you to categorise your spending routinely. Take a look at the classes that take most of your cash, together with recurring standing orders and direct debits. Writing it out by hand can provide you a second of pause to work out how a lot it can save you, fairly than berating your self every month whenever you fail since you didn’t take an excellent have a look at what’s attainable.

How a lot curiosity am I paying on money owed?

Many individuals wouldn’t have the ability to inform you how a lot the curiosity on their mortgage is costing in kilos and pence, however it’s value making the trouble to take a look at your assertion, as a result of chances are you’ll realise you possibly can save with a special product. Should you’re paying curiosity on a bank card, you virtually definitely don’t have to be. Get on to a 0% steadiness switch deal. Should you repaid the minimal funds on a debt of £1,000 on a bank card with an rate of interest of 20%, you’d pay £2,317 to clear the debt, over 18 years and 4 months. Should you modified to a hard and fast fee of £25 a month, you’d pay £1,559 to clear it, and it might take 5 years and three months. Use the reimbursement calculator on the Barclaycard web site.

Ought to I share all my cash with my associate?

Folks usually fall into monetary preparations reminiscent of residing collectively, taking out a joint account or conserving their funds separate with out enthusiastic about the implications. Joint monetary merchandise might be helpful, however they imply your credit score information are tied, so in case your relationship fails, or if a associate is much less reliable, you’re impacted, too. Life modifications; chances are you’ll all the time have had separate cash, then begin a household so considered one of you is incomes much less, or considered one of chances are you’ll go self-employed, and all of the sudden you’ve obtained a really totally different state of affairs. Take into consideration whether or not your perspective and your associate’s perspective to cash align and the way you’re feeling about being financially reliant on one another. On a extra granular stage, take into consideration who’s paying for what; childcare prices, for instance, are inclined to have an effect on ladies’s funds, fairly than a household’s funds. That shouldn’t be the case. Ladies even have dramatically much less financial savings, investments and pension pots as they get into their 40s, however that’s one thing you may appropriate inside a household when you’ve talked about it. A associate will pay into your pension when you’re on maternity depart, for instance.

after e-newsletter promotion

What feelings drive my spending?

Spending is commonly pushed by guilt, envy, pleasure or boredom. You might assume somebody is “good with cash” as a result of they save quite a bit, however that may also be pushed by feelings reminiscent of a worry of not having sufficient. Throughout the pandemic, lots of people overspent as a result of they soothed troublesome feelings by occurring Amazon, then ready for the dopamine hit of a supply. It’s really easy to really feel one thing, then spend – you faucet your card, hit “purchase now”, use Purchase Now Pay Later – however as a way to put a little bit of a barrier in place, take into consideration why you’re spending.

Am I claiming every thing I’m owed?

Final yr the quantity of unclaimed advantages stood at £22.7bn. That features issues reminiscent of pension credit score, carers’ allowance, baby profit (which is out there to anybody who earns underneath £60,000) and council tax help, but additionally social tariffs, so when you’re on a sure earnings, you possibly can get barely cheaper broadband and cell phone offers. Lots of of 1000’s of individuals don’t declare tax-free childcare, which is for anybody who earns underneath £100,000 and is value £2,000 a yr. Marriage allowance is one other factor that a lot of individuals aren’t conscious of. There’s additionally quite a bit you may get tax aid on, such because the cycle to work scheme. The web site entitledto.co.uk exhibits you every thing you may declare.

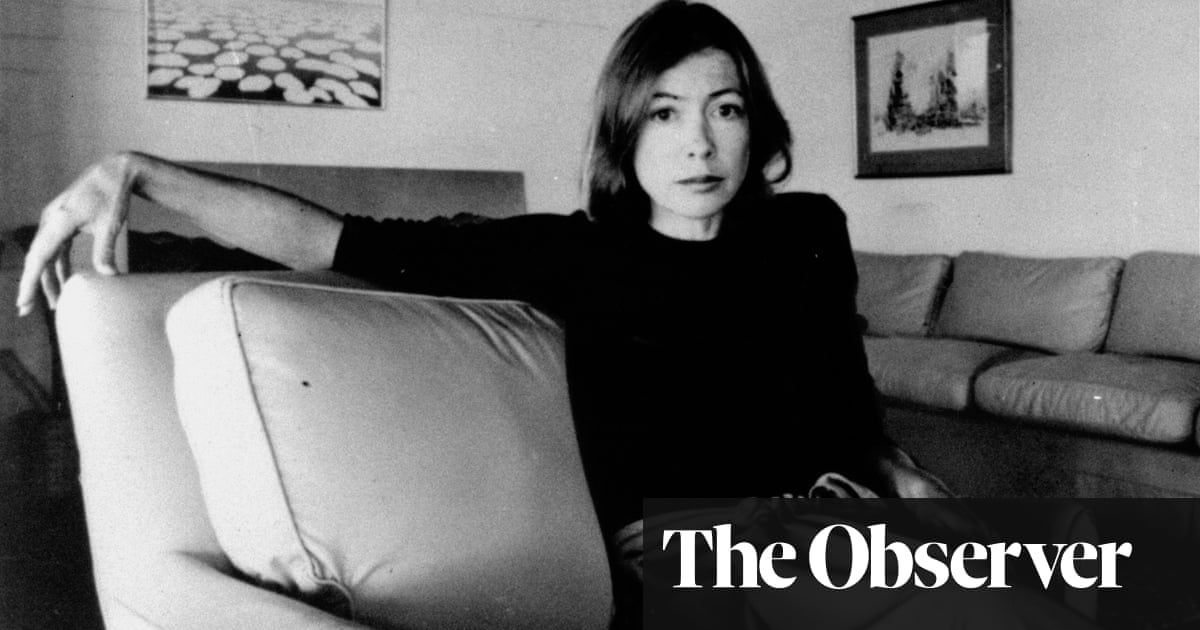

Cash: A Person’s Information by Laura Whateley is printed by Fourth Property. To help the Guardian and Observer, order your copy at guardianbookshop.com. Supply prices could apply.

Supply hyperlink