As Sheikh Hasina watched Dhaka fade from view, aboard a army helicopter, crowds have been storming her palatial residence.

Far under, about 1,000 Bangladeshis lay useless and numerous extra injured, the toll of a brutal crackdown by her safety forces on student-led protests, typically referred to as the Monsoon Revolution. Hasina was quickly in India, the place she has remained in exile since August.

Now, as Bangladesh rebuilds after her 16-year reign, consideration has turned to reclaiming funds allegedly misplaced to corruption by members of her deposed regime and its allies – cash the nation’s interim leaders say is badly wanted for its reconstruction.

Bangladeshi authorities imagine a handful of highly effective households and companies linked to Hasina’s Awami League celebration acquired billions of kilos by illicit means, together with big loans from state-owned banks which have by no means been repaid. These funds, investigators imagine, might have been siphoned out of Bangladesh utilizing the hundi system of cash switch in style in South Asia.

The vacation spot for a few of that cash has been, in accordance with investigators and the brand new regime, a well-recognized house for illicit funds: the UK.

Dhaka’s interim authorities has enlisted assist in monitoring down about £13bn of property, following a world paper path they imagine results in hiding locations that embody London property.

At present, an investigation by the Observer, in partnership with marketing campaign group Transparency Worldwide, reveals Bangladeshi energy gamers accused of corruption have amassed a portfolio of British actual property value virtually £400m – and presumably way more.

The community of about 350 properties ranges from modest flats to mansions in gated communities. Their house owners embody UK and offshore corporations owned by a few of Bangladesh’s wealthiest and most influential businessmen, in addition to two ex-ministers of the Hasina regime. The house owners declare the allegations are politically motivated assaults by the brand new regime.

The findings elevate questions on guidelines governing a phalanx of British corporations – together with main banks, legislation corporations and property brokers – that earned good-looking charges for his or her providers on multimillion-pound property transactions. They’ve prompted concern amongst MPs and campaigners in regards to the progress of efforts to fight Britain’s popularity as a magnet for soiled cash – specifically whether or not guidelines on background checks and figuring out sources of purchasers’ funds are sufficiently strong.

Now, Transparency Worldwide says, the UK faces the “first check” of its ambition to make London the anti-corruption capital of the world.

The minister’s land and the land minister

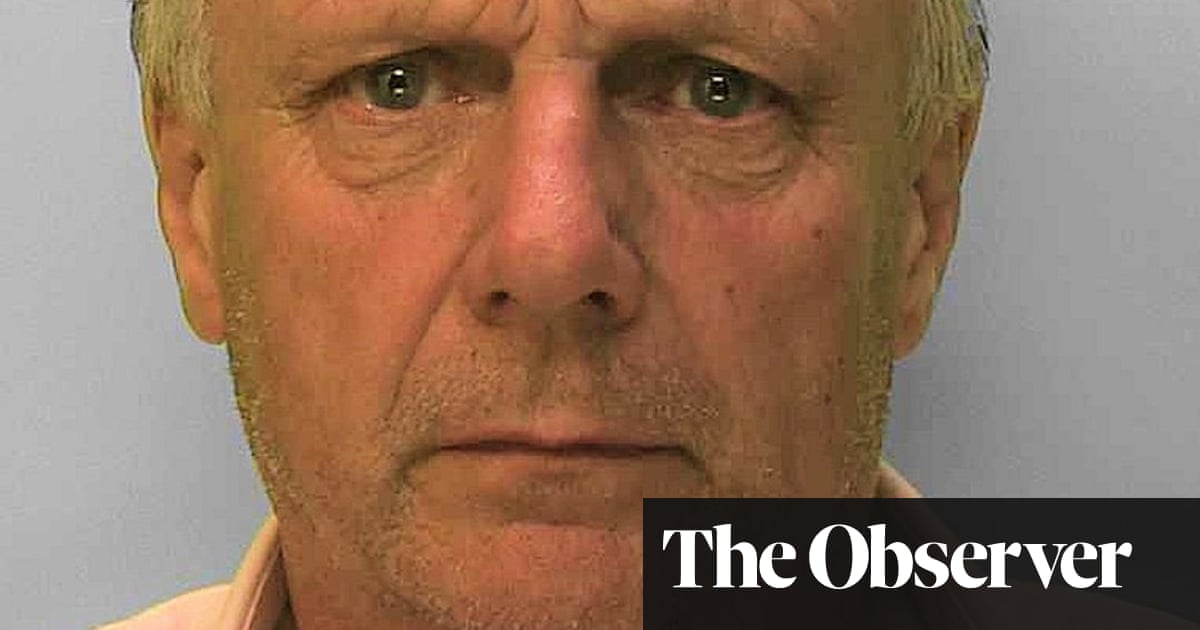

Days after Sheikh Hasina fled Bangladesh, Salman F Rahman was arrested whereas additionally allegedly making an attempt to flee, this time by boat on Dhaka’s community of waterways. Rahman was Hasina’s adviser on personal trade and funding. Many in Bangladesh noticed him as essentially the most influential determine within the regime.

He now faces allegations of money-laundering by the Dhaka-based Felony Investigation Division (CID), a specialist investigative unit. The Bangladesh Monetary Intelligence Unit (BFIU), a part of the central financial institution, has frozen his financial institution accounts and people of members of the family.

Rahman is the co-founder and vice chair of Beximco, considered one of Bangladesh’s largest conglomerates, with sprawling pursuits in all the pieces from garment manufacture to prescribed drugs.

For the reason that Awami League got here to energy, advantages that Beximco is reported to have loved embody the refinancing of huge loans from state-owned banks. It even held a nationwide monopoly on distribution of the Oxford-AstraZeneca Covid vaccine to a nation of greater than 170 million folks.

Now, nonetheless, its monetary affairs – together with round £1bn of allegedly unpaid loans – are below investigation by the Nationwide Board of Income, the nation’s tax authority. Bangladesh’s central financial institution has appointed a custodian to supervise its funds.

Beximco is a household affair. Each Rahman’s son, Ahmed Shayan, and his nephew, Ahmed Shahryar, have held the place of chief govt officer or run key divisions, in accordance with LinkedIn and firm publications.

The duo are below investigation by the CID, whereas Ahmed Shayan’s property within the nation have been frozen.

Authorities tracing that cash have alighted on Grosvenor Sq., in London’s Mayfair district, among the many largest and most prestigious of the capital’s 18th-century backyard plazas.

Members of the Rahman household personal – or maintain stakes in – seven luxurious residences there, most by way of corporations based mostly in offshore jurisdictions. One, purchased for £26.75m in March 2022, is owned – by way of a British Virgin Islands firm – by Ahmed Shayan Rahman. He additionally owns one other flat within the sq. that price £35.5m.

Offshore corporations managed by his cousin, Ahmed Sharyar, personal an extra 4 properties value a mixed £23m, in the identical sq. and close by.

Legal professionals for Ahmed Shayan Rahman and Ahmed Shahryar Rahman stated the properties had been acquired in full compliance with monetary rules, together with money-laundering guidelines.

They stated the boys had no details about Dhaka’s investigation of Beximco and that police investigations into the pair appeared to narrate to a civil dispute relating to export commerce. Additionally they indicated that the interim Dhaka authorities was focusing its corruption investigations on political opponents.

The central financial institution governor, Ahsan Mansur, disputes this. “It’s a professional authorized course of … towards those that have taken assets from Bangladesh,” he advised the Observer. “We need to get it again.”

Sources near the interim authorities level to the truth that officers who make up the authorities investigating the nation’s misplaced property should not merely enemies of the Awami League however come from a combination of backgrounds, each in politics and civil society.

However at the least one different former Awami League determine, the previous land minister Saifuzzaman Chowdhury, is below scrutiny. His financial institution accounts have been frozen by the BFIU, whereas a courtroom has ordered the seizure of immovable property owned by him and members of the family. He’s topic to a journey ban and Dhaka’s Anti-Corruption Fee is investigating allegations that he illegally acquired a whole bunch of hundreds of thousands of {dollars}.

Investigators need to know the way he and his household acquired an unlimited UK property portfolio of greater than 300 titles, acquired for at the least £160m, in accordance with the UK’s Land Registry.

Reporters for Al Jazeera noticed Chowdhury outdoors one, a £14m London mansion, final month, however he has not responded to requests for remark from the Observer, despatched by e-mail and letter. He has stated that funds used to purchase his abroad properties had come from professional companies outdoors Bangladesh.

City, nation and Dubai

However it isn’t simply former ministers who’ve amassed a formidable portfolio of British property. So, too, did a number of the enterprise figures who flourished below the Awami League’s reign.

With its tree-lined personal roads {and professional} safety guards, Wentworth – constructed across the golf course of the identical title – is the proper bolthole for a privacy-conscious multimillionaire. The celebrated Surrey property is house to a number of members of the Sobhan household, headed by patriarch Ahmed Akbar, generally known as Shah Alam.

Family members personal two huge properties right here, acquired for a mixed £13m and owned by way of corporations registered within the British Virgin Islands, Golden Oak Enterprise Restricted and Kaliakra Holdings Restricted.

A 3rd, a French-style mansion, owned by considered one of Shah Alam’s sons, seemed to be below building when the Observer visited.

The event itself is owned by way of an Isle of Man firm referred to as Cessnock Restricted. A contractor engaged on the mission emphasises its core worth – “discretion”.

The Sobhan household’s wealth comes from the Bashundhara Group, a conglomerate with pursuits spanning actual property, delivery, media and sport. The household have been first investigated over corruption allegations in 2008 however later cleared. The autumn of the Hasina regime has triggered a contemporary probe, together with scrutiny of the alleged failure to repay state loans.

On 21 October, a Dhaka courtroom issued a journey ban towards six members of the Sobhan household, together with Shah Alam, whereas the BFIU has frozen their financial institution accounts.

Dhaka authorities are believed to be scrutinising the household property, together with property, anticipated to be a magnet for a brand new asset restoration taskforce. They imagine, regardless of strict foreign money controls that forestall residents from transferring greater than $12,000 overseas, billions have been diverted overseas, together with by means of hubs corresponding to Singapore and Dubai.

Two household properties elevate questions in regards to the function of these monetary centres as staging posts for cash pouring into UK property. One £10m mansion, on a gated property in London’s Kensington, is owned by Shah Alam’s son and the vice chairman of Bashundhara Group, Safwan Sobhan, by means of an organization referred to as Austino Restricted. Austino is registered within the British Virgin Islands however a Land Registry file documenting the acquisition of the home directs correspondence to Atro Worldwide, a building supplies enterprise based mostly in Dubai.

after publication promotion

An analogous association pertains to a £5.6m Chelsea waterfront property owned by Safwan’s brother, a part of a portfolio amassed at a price of £28m. The residence was bought by Crimson Pine Buying and selling, which is predicated within the British Virgin Islands however provides its deal with as a tower in Singapore.

Safwan Sobhan, answering on behalf of himself and his brother, stated the household “strongly refute all allegations of wrongdoing and can robustly defend ourselves towards these allegations.

“We contemplate the investigations to be legally weak and politically pushed,” he stated, referring to a Home of Commons analysis temporary from September 2024, which referred to considerations about concentrating on of Hasina’s allies and associates.

He didn’t reply questions in regards to the function of Dubai and Singapore within the possession of UK properties by way of BVI-registered corporations.

Down the highway from Safwan Sobhan’s Kensington pad lie a clutch of properties owned by one other tycoon who’s feeling the Dhaka warmth.

Nazrul Mazumder, the founder and chairman of one other Bangladeshi conglomerate, Nassa Group, is below investigation by the Dhaka CID for alleged cash laundering, whereas his property have been frozen by the BFIU.

Bangladeshi authorities are anticipated to look at how Mazumder and his members of the family funded the acquisition of 5 luxurious properties in Kensington, south-west London, purchased for a mixed £38m.

Native inquiries by the Observer point out that a lot of the properties have been rented out, guaranteeing a gradual revenue for Mazumder, as he faces prices in his house nation.

Sources near Mazumder indicated that he rejected any suggestion that the properties have been bought with funds acquired illicitly and would contest allegations made towards him in Bangladesh.

The British connection

In observe, the true scale of properties owned by Bangladeshi politicians and enterprise figures could possibly be a lot higher than that recognized by the Observer.

As of 2023, the UK publishes knowledge on abroad entities that maintain land titles. However possession may be simply hidden by merely wrapping the property-owning firm inside one other offshore car, like an nameless belief. This loophole is only one concern shared by those that query the adequacy of the UK’s transparency regime.

Now, consideration is now turning to the compliance guidelines governing Metropolis corporations corresponding to these concerned in serving to members and allies of the Hasina regime handle their property wealth.

MPs on the all-party parliamentary group (APPG) for anti-corruption need British regulators to have a look at whether or not the background checks that UK corporations are required to do on property buyers are sufficiently strong.

Nazrul Mazumder and an organization by which he’s a shareholder have borrowed from the British department of Swiss financial institution UBS and from Coutts, the personal financial institution that additionally serves the royal household, to fund his household’s Kensington properties.

Salman F Rahman’s son purchased his £26.75m Grosvenor Sq. pad utilizing a mortgage offered by the UK department of Credit score Suisse, with the help of legislation agency Charles Russell Speechlys. Each he and his cousin, Ahmed Shahryar, purchased properties with a mortgage from Barclays. One other London legislation agency, Jaswal Johnston, has ceaselessly labored on property offers for Rahman members of the family.

Members of the Sobhan household have benefited from the recommendation of Orbis London, the UK outpost of an actual property adviser with workplaces in Liechtenstein, Singapore and Switzerland.

Chowdhury’s huge portfolio was acquired and managed with help from corporations together with the property agent Transferring Metropolis, legislation agency Charles Douglas and lender Market Monetary Options.

There are a lot of extra, too quite a few to call. All are required to carry out due diligence on their purchasers’ supply of wealth, together with enhanced checks on “politically uncovered individuals” (PEPs) corresponding to Chowdhury and Salman F Rahman, and their households.

“We want stronger anti-money-laundering supervision and enforcement to analyse the supply of the wealth flowing by means of London,” stated Joe Powell MP, the APPG’s chair. “I assist all efforts by the Bangladesh authorities to hint property they imagine might have been improperly acquired.”

The minister most carefully chargeable for scrutinising and updating the principles that govern the UK’s monetary sector is the Metropolis minister, Tulip Siddiq. She additionally occurs to be the niece of Sheikh Hasina.

In 2022, it emerged that Siddiq’s mom, Sheikh Rehana – one of many Awami League’s strongest figures – was dwelling rent-free in a London property owned by Ahmed Shayan Rahman.

There isn’t any suggestion of wrongdoing by Siddiq, who is known to have recused herself from any policymaking regarding Bangladesh.

This month, members of the APPG wrote to a string of UK regulators and legislation enforcement our bodies urging them to look into whether or not British corporations who assisted Saifuzzaman Chowdhury had achieved adequate due diligence. For his or her half, every agency stated it had. The identical MPs are calling on the British authorities to depart no stone unturned in serving to Bangladesh get better funds wanted to rebuild the nation.

Campaigners say this will probably be an important check of the urge for food for strengthening London’s moral credentials.

Transparency Worldwide warned that the UK was nonetheless seen as a “premier vacation spot for these with suspicious wealth to take a position”.

Duncan Hames, coverage director of Transparency Worldwide, stated the federal government ought to “work carefully with allies world wide and companions in Bangladesh to introduce a sanctions regime which freezes suspicious property. “Rising to this second is the primary check of the brand new authorities’s said ambition to grow to be the anti-corruption capital of the world.”

Prof Mushtaq Khan, a professor at Soas College of London specialising in corruption, believes the UK authorities ought to contemplate diverting a number of the help funds into serving to Bangladesh get better funds.

In the end, he says, the restoration effort should deal with honouring those that died within the Monsoon Revolution. “It was the most important bloodbath within the historical past of Bangladesh,” he stated. “We will’t let these folks down.”

Barclays, Coutts, Charles Russell Speechlys and UBS, which owns Credit score Suisse, declined to remark. Orbis London didn’t return requests for remark. Market Monetary Options, Charles Douglas Solicitors and Jaswal Johnston all stated that they had complied with all related money-laundering rules, together with finishing up strict due diligence checks on clients’ supply of wealth.

Transferring Metropolis stated it had “at all times carried out detailed and in depth due diligence checks in strict compliance with relevant rules and trade observe”.

“In any respect materials instances, Transferring Metropolis has understood that the funds utilized by Mr Chowdhury to buy UK property originated from professional companies within the UAE, US and UK,” stated a spokesperson for the agency.

Supply hyperlink