Key occasions

Matt Britzman, senior fairness analyst at Hargreaves Lansdown, stated:

Simply when it appeared the tariff chaos couldn’t get any worse, tech traders have spent the weekend scrambling to make sense of a whirlwind of complicated – and at instances contradictory – messages popping out of the White Home. Regardless of the drama, European markets have taken an easing stance on US tech elements as a optimistic in a broad-based rally this morning, with the FTSE 100 up 1.5% in early buying and selling.

This time, it’s chips, smartphones, and different tech elements taking centre stage. Whereas there have been early indicators on Friday evening that some broad exemptions may be in play, it seems tariffs are nonetheless very a lot on the desk. However right here’s the twist: regardless of the messy rollout, what’s caught traders’ consideration is the information that these merchandise gained’t be hit with the tough China-specific tariffs. As an alternative, it appears like an current 20% tariff might be utilized – a minimum of for now – whereas additional selections round how greatest to cope with this bucket of merchandise go on within the background.

The online impact is optimistic for tech, particularly for giants like Apple, which may’ve seen their whole pricing technique thrown into disarray beneath the proposed 145% China tariffs. As an alternative, this reprieve, and information that additional tariffs might be a few months away, offers Apple time to construct up its US stock to cowl the present iPhone gross sales cycle with no need knee-jerk value hikes. Selections on pricing can then be made alongside the launch of its newest handset in September. It’s nonetheless a bit chaotic, however it is a higher final result for the tech sector than once we closed on Friday and, in consequence, US futures are buying and selling increased – at the same time as volatility spikes but once more.

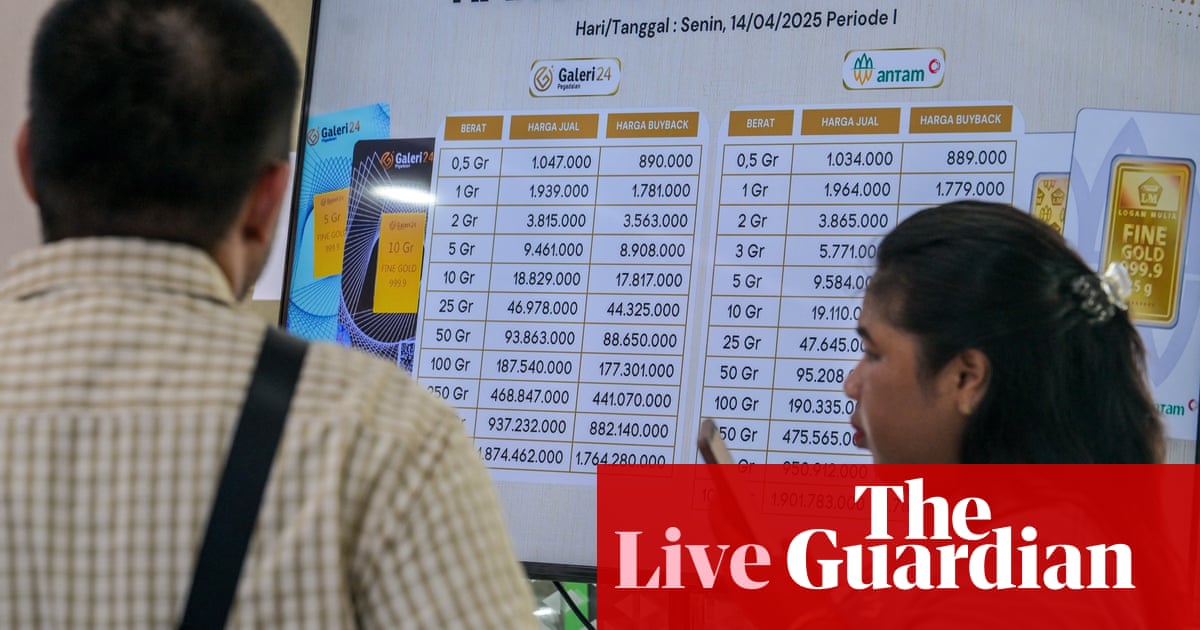

One asset shining brightly amid the chaos is gold. It’s been on a exceptional upward pattern this 12 months, with just a few minor stumbles alongside the best way. This weekend’s tariff antics have solely amplified its safe-haven enchantment, pushing costs to yet one more all-time excessive as traders seek for property uncorrelated to White Home drama.

European shares bounce; greenback slides

European shares have bounced on the open, with main indices rising by greater than 2%.

In London, the FTSE 100 index jumped by 130 factors, or 1.6%, to eight,090. The German, French and Italian markets rose by greater than 2% in early buying and selling.

The US greenback is on the backfoot once more, retreating by 0.8% towards a basket of main currencies. The pound has gained by 0.7% towards the buck whereas the euro is 0.55% forward.

Yields (or rates of interest) on eurozone authorities bonds are rising, after falling on Friday, because the exclusion of Chinese language electronics from steep new US import tariffs eased fears in regards to the influence of US commerce coverage on the worldwide financial system.

Germany’s 10-year yield, the eurozone’s benchmark, rose by 4.5 foundation factors to 2.57%, after declining by 5.5 bps on Friday.

Chinese language president Xi Jinping has warned there might be “no winners” in a commerce struggle and that protectionism “leads nowhere”, as he started a three-nation journey to south-east Asia beginning in Vietnam on Monday.

Xi’s tour, which started in Hanoi, additionally contains uncommon visits to Malaysia and Cambodia and can search to strengthen ties with China’s closest neighbours amid a commerce struggle that has despatched shockwaves via world markets.

Writing in an article revealed in Vietnam’s Nhan Dan newspaper on Monday, Xi urged Vietnam to “resolutely safeguard the multilateral buying and selling system, secure world industrial and provide chains, and open and cooperative worldwide atmosphere”, Beijing’s Xinhua information company stated.

He added {that a} “commerce struggle and tariff struggle will produce no winner, and protectionism will lead nowhere”.

He known as for stronger ties with Vietnam on commerce and provide chains, and stronger ties with Hanoi on synthetic intelligence and the inexperienced financial system.

The go to, which had been deliberate for weeks, comes as Beijing faces 145% duties on its exports to the USA, whereas Vietnam is attempting to barter a discount of threatened US tariffs of 46% that may apply in July after a world moratorium expires.

China exports leap in March forward of newest tariffs

China’s exports rose sharply final month as factories rushed out shipments earlier than the newest US tariffs took impact, and due to the timing of the lunar new 12 months vacation.

Exports climbed by 12.4% year-on-year in March, a five-month excessive, and forward of economists’ expectations of 4.4% progress. In February, they fell by 3%. The rebound was largely associated to the timing of the lunar new 12 months, as the vacation fell in early February this 12 months.

Nonetheless, economists warned that this can quickly be eclipsed by the escalating commerce struggle between the US and China.

Julian Evans-Pritchard, head of China economics at Capital Economics, stated:

Export progress accelerated in March, as producers rushed to ship items to the US forward of ‘Liberation Day’. However shipments are set to drop again over the approaching months and quarters.

We expect it may very well be years earlier than Chinese language exports regain present ranges.

By vacation spot, exports have been supported by a pointy restoration to the G7, particularly the US, the place shipments rose by 9.1% year-on-year in March, in comparison with a fall of 9.8% in February. Exports to the UK jumped by 16.3% from a 13.9% drop, whereas shipments to the EU rebounded to 10.3% following a 11.5% decline in February. Exports to Africa jumped by 37% and shipments to ASEAN nations rose by 11.6% following February’s 8.8% rise (shipments to the area didn’t dip throughout the festive interval as they did elsewhere).

Kelvin Lam, senior China+ economist at Pantheon Macroeconomics, stated:

On commerce coverage, president Trump exempted some electronics imports from tariffs late Friday, later clarifying that it was solely a brief reprieve, with new sector-specific tariffs to be imposed on semiconductors and client electronics within the “not too distant future.”

Notably, the suspension doesn’t apply to the prevailing 20% tariff imposed on China over its position within the fentanyl commerce. In any case, the momentary reduction for the electronics sector might supply some respiratory room for Chinese language exporters earlier than the brand new tariffs come into impact. We anticipate extra readability on the brand new tariff charges as soon as the Part 232 Investigation concludes — with a probable vary of 10% to 125%, in line with US Commerce Secretary Howard Lutnick.

Introduction: Asian markets rise on indicators of Trump tariff retreat; British Metal races to maintain furnaces burning

Asian shares have risen regardless of a warning from US officers that an exemption of smartphones, laptops and different digital merchandise from import tariffs on China can be short-lived. Donald Trump has warned that nobody is ‘getting off the hook’, whereas a Chinese language official pronounced that ‘the sky gained’t fall’.

Japan’s Nikkei gained 1.4% whereas Hong Kong’s Hold rose by 2% and the Shanghai and Shenzhen exchanges climbed by 0.7% and 0.4% respectively.

The positive factors have introduced some respite to markets after days of heavy promoting when trillions of {dollars} have been wiped off world inventory markets, as a wave of US tariffs despatched shockwaves all over the world.

A Chinese language customs official stated “the sky gained’t fall” for the nation’s exports, regardless of the darkening outlook, in line with the state information company Xinhua, as Beijing launched knowledge displaying a leap in China’s exports in March.

In recent times, China has made regular progress in diversifying its commerce markets and deepening industrial and provide chain cooperation with companions all over the world, in line with Lyu Daliang, an official on the Common Administration of Customs.

These efforts haven’t solely supported our companions’ improvement but additionally enhanced our personal resilience.

US shares are additionally anticipated to stage a restoration later as we speak, after the US president excluded imports of smartphones and laptops from his tariff regime late on Friday evening. Nonetheless, he stated in a social media submit on Sunday:

There was no Tariff ‘exception’. These merchandise are topic to the prevailing 20% Fentanyl Tariffs, and they’re simply transferring to a special Tariff ‘bucket.’

Within the submit on his Fact Social platform, Trump promised to launch a nationwide safety commerce investigation into the semiconductor sector and the “entire electronics provide chain”.

Trump advised reporters aboard Air Power One, as he travelled again to Washington from his property in West Palm Seaside, that tariffs on semiconductors can be introduced this week and a choice on telephones made “quickly”.

Gold has hit a brand new document excessive, of $3,245.42 an oz., seen as a safe-haven in instances of turbulence. It’s now traded at $3,232 an oz., down 0.1% on the day.

In the meantime within the UK, British Metal is to deploy emergency measures in a race towards time to save lots of the blast furnaces at Scunthorpe, whereas the enterprise secretary, Jonathan Reynolds, declined to ensure the plant may get what it wanted in time.

The corporate is known to be provides of assist from greater than a dozen companies to acquire supplies reminiscent of iron ore and coking coal, doubtlessly permitting it to keep away from the momentary shutdown of one of many two furnaces.

On Saturday, parliament handed a one-day invoice containing emergency powers to realize management of the Scunthorpe web site after its Chinese language proprietor, Jingye, declined authorities assist to maintain the plant working over the following few weeks. British Metal’s UK administration crew is now scrambling to purchase the supplies, with assist from authorities officers.

Supply hyperlink